The Perception of Gold in India: Why Rising Gold Prices Don’t Create a Real Wealth Effect

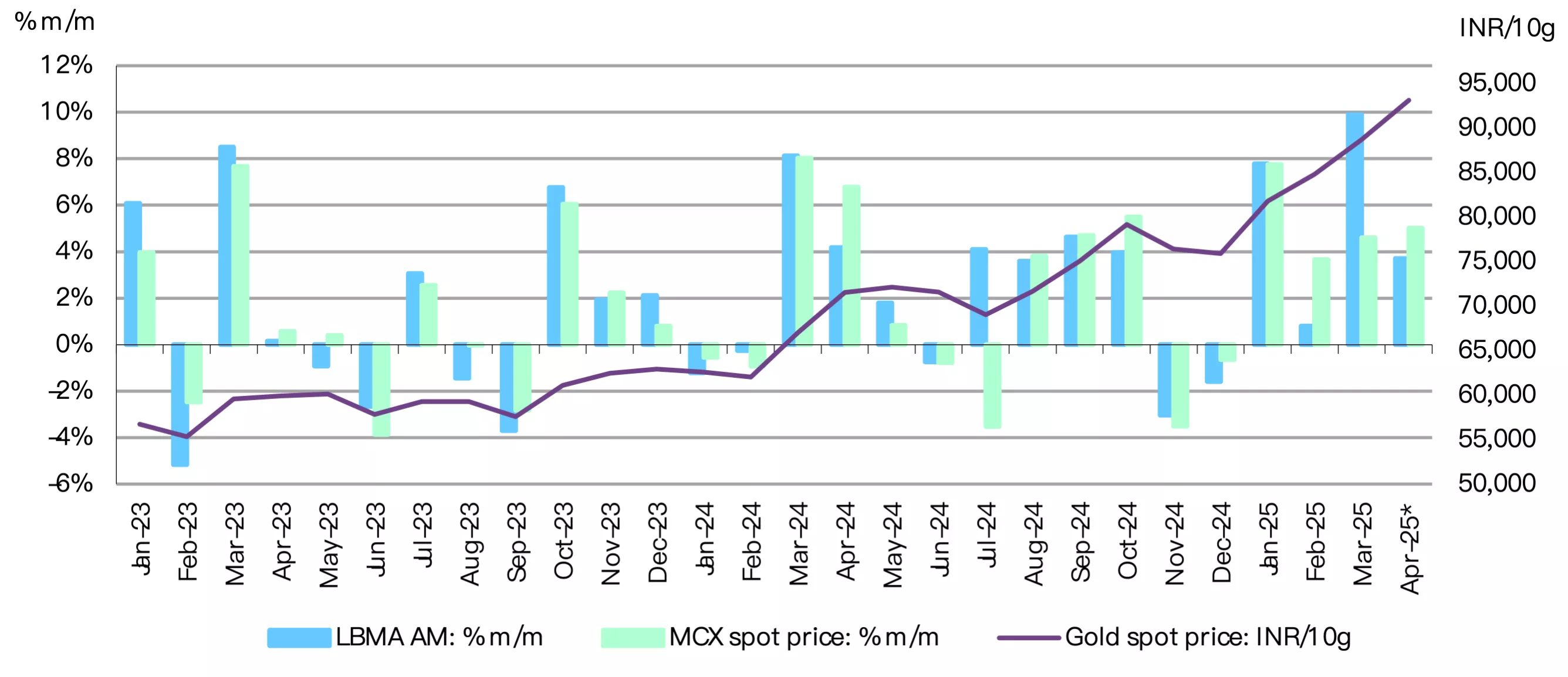

Gold holds a unique psychological, cultural, and financial position in India. With gold prices rising over 60% in the last year, a natural question arises:

Does this surge in gold prices create a real wealth effect that boosts consumption and economic growth?

The short, uncomfortable answer: mostly no.

Let’s break this down logically, without emotion or nostalgia.

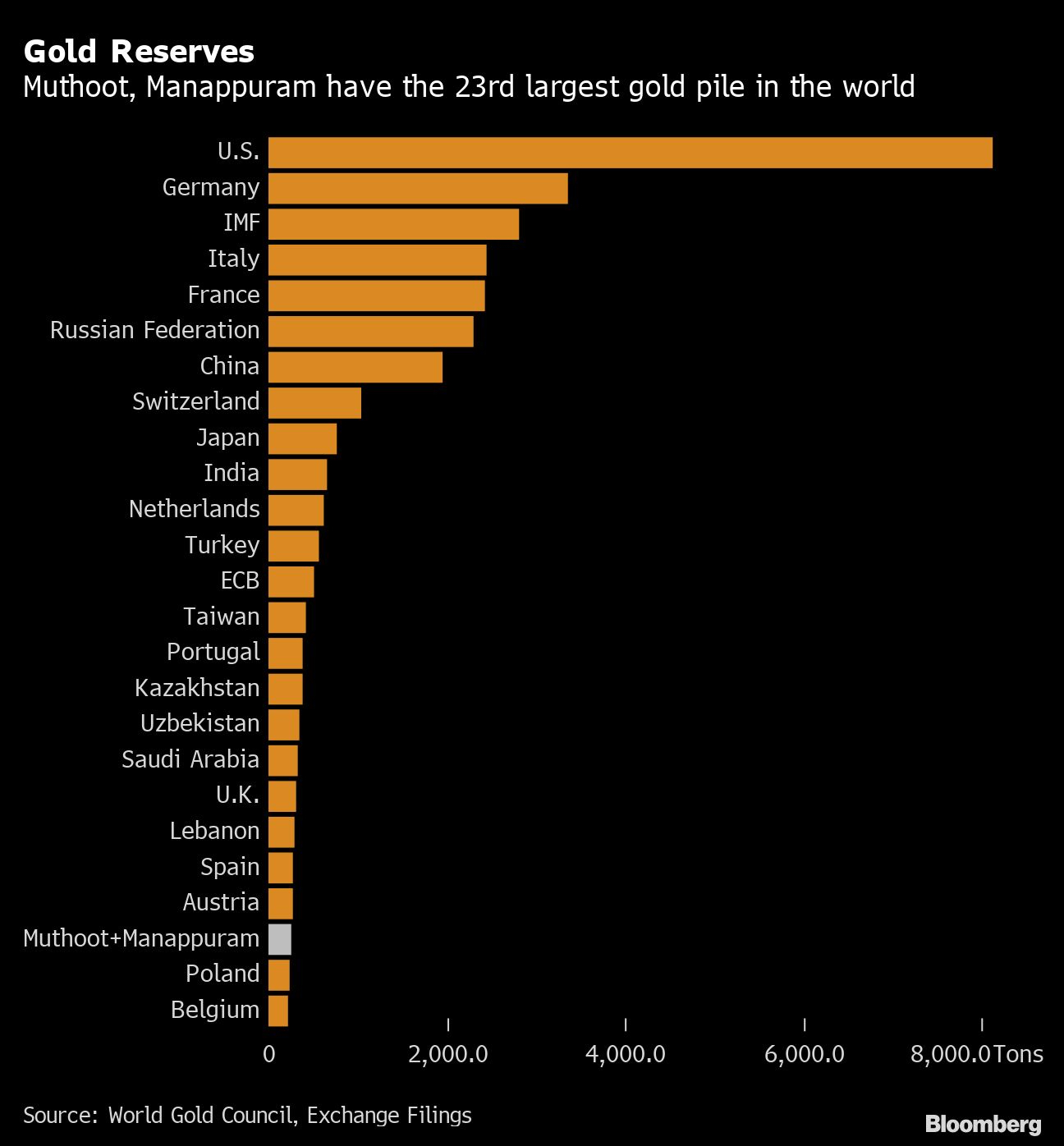

1. India’s Gold Wealth Is Massive — Bigger Than Its GDP

According to estimates by Morgan Stanley, Indian households collectively hold around:

Valued at roughly $5 trillion

This is higher than India’s nominal GDP, which is about $4.1 trillion (IMF estimates)

In global terms:

India accounts for ~26% of global gold demand

China accounts for ~28%

Together, India and China drive more than half of global gold consumption

On paper, this looks like enormous household wealth.

But wealth on paper is not the same as usable economic wealth.

2. Most Household Gold Is Not a Financial Asset

Here lies the core issue.

Composition of household gold:

75–80% is held as jewellery

Remaining is in coins or bars

Very little is held via financial instruments like ETFs or sovereign gold bonds

Jewellery is:

Illiquid

Emotionally charged

Socially and culturally “untouchable”

Selling gold jewellery is still perceived as a financial distress signal, not a smart portfolio decision.

This single factor breaks the wealth-effect argument.

3. Gold Is a “Store of Value”, Not a Spending Trigger

Gold in India functions primarily as:

A hedge against uncertainty

A cultural and emotional asset

When gold prices rise:

People feel richer

But they don’t spend more

There is no strong empirical evidence showing that spikes in gold prices lead to:

Higher household consumption

Sustained GDP acceleration

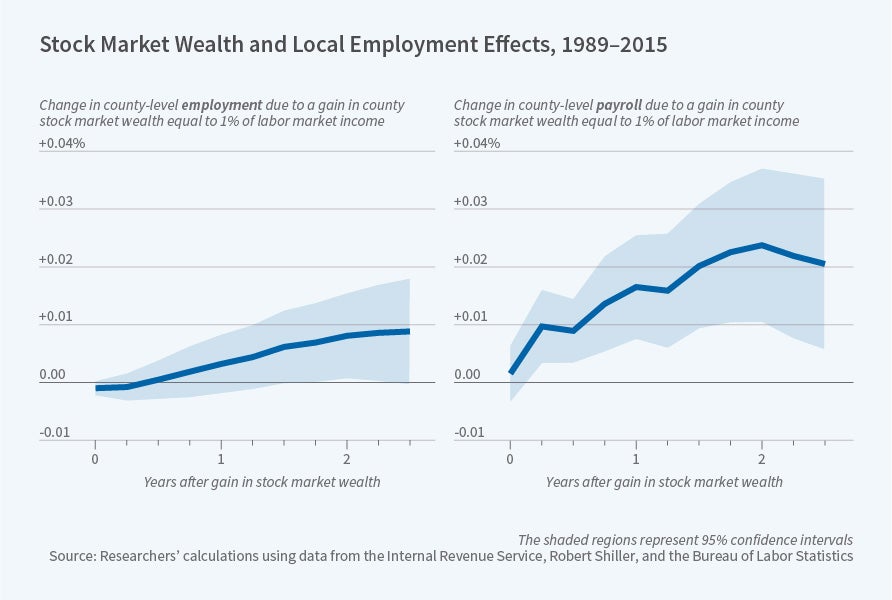

This contrasts sharply with equity markets.

4. Psychological Asymmetry: Gold vs Equity

Here’s an uncomfortable truth about investor behavior:

When gold prices rise:

People worry gold has become “too expensive”

They postpone buying

They reduce quantity (lighter jewellery, lower carat)

They do not think of selling

When equity prices rise:

Investors see higher net worth

They rebalance portfolios

They book profits

They increase discretionary spending

Gold appreciation creates price anxiety, not spending confidence.

5. Gold Is Rarely Counted as Net Worth

Most Indian households:

Track bank balances

Track fixed deposits

Track EPF, PPF, mutual funds, stocks

But gold jewellery?

Rarely updated in balance sheets

Rarely treated as “deployable wealth”

Often mentally categorized as emergency-only

This mental accounting flaw ensures gold price rallies remain economically dormant.

6. Liquidity and Income Generation Matter for Wealth Effect

A real wealth effect requires three conditions:

Liquidity – easy to convert into cash

Income generation – dividends, interest, cash flows

Low emotional friction – no stigma in selling

Gold fails on all three:

Liquidity exists technically, but not psychologically

Gold produces no income

Selling gold is emotionally painful

Equities, on the other hand:

Are highly liquid

Generate dividends and capital gains

Are routinely bought and sold

That is why equity-led rallies boost consumption — gold rallies don’t.

7. RBI Gold Holdings Don’t Change the Household Story

The Reserve Bank of India holds about:

~880 tonnes of gold

Roughly 14% of India’s forex reserves

While this supports currency stability and balance-sheet strength at a sovereign level, it has no direct transmission to household consumption.

Household gold ≠ spending power.

8. Why Gold Still Feels Important (Even If It Isn’t Economically Active)

Gold persists because:

It protects against inflation

It acts as intergenerational wealth

It offers emotional security

It performs well during crises

These are valid reasons.

But they do not translate into a consumption boom, even after a 60% price rally.

Final Conclusion: Gold Creates Comfort, Not Consumption

Gold price appreciation:

✔ Makes households feel secure

✔ Improves perceived wealth

✖ Does NOT materially increase spending

✖ Does NOT generate a strong wealth effect

If any asset class creates a true wealth effect, it is equities, not gold — because they are liquid, income-generating, and psychologically “sellable”.

Gold in India is financially powerful but economically passive.

And unless its perception shifts from emotional asset to financial asset, even massive gold rallies will continue to sit quietly — admired, but unused.

Comments

Post a Comment