Why Are Foreign Institutional Investors (FIIs) Leaving India — And Why Aren’t They Coming Back?

For years, Foreign Institutional Investors (FIIs) were considered the backbone of the Indian equity market. Heavy FII inflows often meant bull markets, rising valuations, and global confidence in India’s growth story.

That assumption is now outdated.

In 2025, India has witnessed one of the largest FII outflows in its market history, estimated at nearly ₹1.6 trillion, and unlike previous cycles, FIIs are not returning the following year. This break from historical patterns signals a deeper structural problem.

Let’s examine the real reasons — not narratives, not excuses.

1. Currency Depreciation Is Destroying Real Returns

FIIs invest in foreign currency (USD), but earn returns in Indian Rupees (INR). What matters to them is dollar-adjusted returns, not headline Nifty CAGR.

The harsh math:

India’s rupee has depreciated at ~3.5% annually over the last two decades.

Even a 12–13% equity return gets significantly eroded after:

In many cases, FIIs earn excellent market returns but zero dollar returns when they exit.

By contrast:

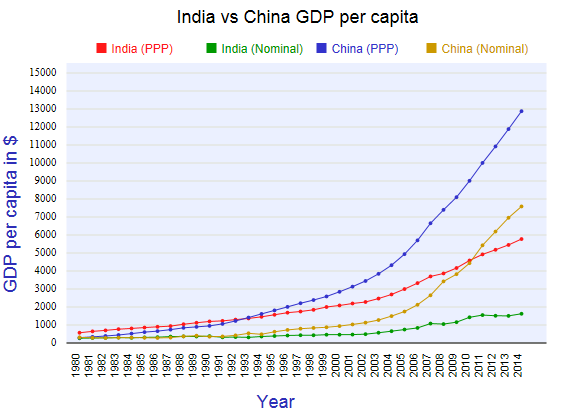

China’s currency has depreciated only ~1% annually

Currency stability converts equity gains into actual wealth

Conclusion:

For FIIs, India looks like a treadmill — lots of effort, little progress.

2. Capital Gains Taxes Reduce Net Returns Further

India has steadily increased Long-Term Capital Gains (LTCG) tax:

Earlier: 0%

Then: 10%

Now: 12.5%

This is a direct hit on post-tax returns.

Meanwhile:

China, Taiwan, and several competing markets do not levy LTCG tax on FIIs

FIIs don’t complain emotionally — they simply reallocate capital.

Key point:

When two markets offer similar gross returns, capital flows to the one with:

Lower taxes

Lower friction

Higher certainty

India fails on all three.

3. Valuations in India Are Uncomfortably Expensive

Post-COVID, Indian markets delivered exceptionally strong returns, especially in:

That success has created a new problem: overvaluation.

Remove PSU banks and a few low-PE government companies

The effective PE of large-cap indices rises toward 40–50

Earnings growth remains 12–15% at best

This is not a margin of safety — it’s a valuation trap.

FIIs don’t chase momentum blindly. When risk-adjusted returns fall, they exit.

4. Better Growth Opportunities Exist Elsewhere (Especially China Tech)

For years, India benefited because China was:

Politically restricted

Regulatory-heavy

Unattractive to foreign capital

That has changed.

China is aggressively pushing:

Automation

Advanced manufacturing

Examples (illustrative, not hype):

AI chip companies: 300%+ returns

Semiconductor firms: 200%+ returns

Tech indices delivering 13–14% CAGR, with currency stability

So if:

India gives 13% CAGR + weak currency + tax

China gives 13% CAGR + stable currency + no LTCG

The decision is obvious.

5. India’s Export Weakness Keeps the Rupee Fragile

Currencies don’t weaken randomly. They weaken due to structural trade deficits.

India’s problems:

Persistent current account deficit

Heavy dependence on:

Oil imports

Gold imports

Weak high-value exports

China, by contrast:

Runs ~$1 trillion annual trade surplus

Forces global demand for its currency via exports

Accumulates massive forex reserves

A weak export engine means:

Rupee depreciation is structural, not temporary

FIIs price this risk in advance

6. Currency Hedging Is Costly in India

Yes, FIIs hedge currency risk — but hedging is not free.

Higher currency volatility = higher hedging cost

INR volatility is significantly higher than CNY

Net returns shrink even further after hedging

At some point, FIIs ask a simple question:

“Why bother?”

7. India Is Lagging in New-Age Tech Listings

Global capital today is chasing:

AI

Semiconductors

Data centers

Advanced hardware

India’s reality:

Very few globally competitive tech-product companies

Most innovation is:

Service-based

Back-end

Captive to foreign firms

Until India creates homegrown, listed, scalable tech leaders, FIIs will remain underweight.

8. Retail Investors Are Replacing FIIs — A Risky Signal

Domestic retail investors are currently absorbing FII selling.

This is not inherently bullish.

History shows:

Retail-driven markets without institutional support are fragile

Liquidity dries up quickly during global stress

FIIs are not emotional — they are forward-looking. Their exit is a warning, not noise.

Final Verdict: Why FIIs Are Staying Away

FIIs are not avoiding India out of pessimism — they’re avoiding it due to math.

The three core reasons:

Currency depreciation erodes dollar returns

High taxes reduce post-tax profitability

Better risk-adjusted opportunities exist elsewhere

Until India:

Stabilizes the rupee via exports

Rationalizes capital gains taxation

Builds globally competitive tech sectors

FIIs are unlikely to return in force.

This is not a short-term cycle.

It is a structural reallocation of global capital.

And pretending otherwise will only delay the solution.

Comments

Post a Comment